All Categories

Featured

Table of Contents

ensure a stream of income for the remainder of the annuitant's life, nonetheless long that might be, or for the life of the annuitant and their spouse if they buy a joint life time annuity. Missing a joint-and-survivor arrangement, nonetheless, the annuitant is the only one that can profit. Consider it as a personal agreement made to benefit the annuitant alone.

The more money that was placed in, and the later the repayments were begun, the bigger those repayments will certainly be. But the contract ends at fatality. If the annuitant purchases a lifetime annuity, it indicates they can not outlive their income stream, but it additionally indicates the successors won't reach assert the advantage after the annuitant's gone., additionally called, pay out over a finite duration of time - Annuity income stream.

As a result, they may perhaps outlast their benefits. On the flipside, however, if they pass away before the agreement expires, the cash can pass to a designated recipient. pay at an assured rates of interest yet supply a fairly small price of return. If you inherit a taken care of annuity, you'll recognize what you're getting in terms of growth.

This sets you back added but offers the recipient the higher of these two payments: The agreement's market price. The total amount of all contributions, once charges and withdrawals are deducted. It is essential to keep in mind that the size of the premium being returned will be much less than it was initially, depending upon exactly how much of it the original annuitant has actually absorbed repayments.

Annuity Beneficiary beneficiary tax rules

are optionalclauses in an annuity agreement that can be made use of to customize it to particular requirements. They come at an added price because they usually supply an additional level of security. The more cyclists bought, the greater the cost is to pay: Each biker normally costs between 0.25% and 1% yearly.

Without such a cyclist, the continuing to be money would certainly revert to the insurance business, to be merged with funds for various other life time annuity owners who might outlive the quantity they 'd spent. It would not go to the heirs. (This is a trade-off for the insurance provider because some annuitants will outlast their financial investments, while others will die early.

It costs additional due to the fact that the insurance provider needs something to offset the cash it could or else utilize for its pool. Is this included price worth it? If the annuitant is in health and thinks they could consume all or a lot of the premium prior to they pass away, it could not be.

Under this rider, the insurance provider tapes the value of the annuity every month (or year), then utilizes the greatest figure to establish the benefit when the annuitant passes away - Annuity income. An SDBR secures recipients of variable annuities against market variations: If the value happens to be down at the time of fatality, the recipient still gets the top-line amount

Yet the safety and securities behind the lotto payout are backed by the united state government, which really makes them more secure than any kind of privately backed annuity. Choosing to take annuitized installation repayments for lotto earnings can have a pair of advantages: It can defend against the temptation to overspend or overextend on responsibilities, which might result in monetary troubles and even bankruptcy later on.

Do you pay taxes on inherited Deferred Annuities

If you get an annuity, you can set the terms of the annuity agreement, choose what sort of annuity to buy, choose whether you want motorcyclists, and make other decisions. If you acquire an annuity, you might not have the same alternatives, particularly if you weren't a partner with joint possession.

Take a lump-sum payout. Take the full payout over the following five years under the five-year policy. Yes. An annuitant can name a primary beneficiary and a contingent recipient, however likewise can call greater than one in either group. There's really no limitation to the number of key or contingent recipients that can be called.

And (sorry, pet enthusiasts), Dog or Floofer can't be called as a beneficiary. An inherited annuity can provide cash for the beneficiary to pay off significant expenses (such as trainee financial obligation, a home loan, health-care prices, and so on)., you can do so in one of 3 means: You can sell all your scheduled repayments for the rest of the annuity contract term and receive a lump-sum payment in exchange.

After those 5 years are up, settlements will certainly return to. If you like not to wait for payments to begin up once more, but you require some money currently, you can sell a section of each settlement and obtain a lump amount.

Taxes on Multi-year Guaranteed Annuities inheritance

Relying on your debt, the term of the financing and other aspects, you could wind up paying nearly as much in rate of interest as you obtained with the finance. A 30-year home mortgage worth $200,000 would cost you a total of even more than $343,000 when all is claimed and done.

Among the most crucial is when the annuity was bought. If you purchased an annuity before your marital relationship, it may be considered your separate residential property and not eligible to be separated by the court.

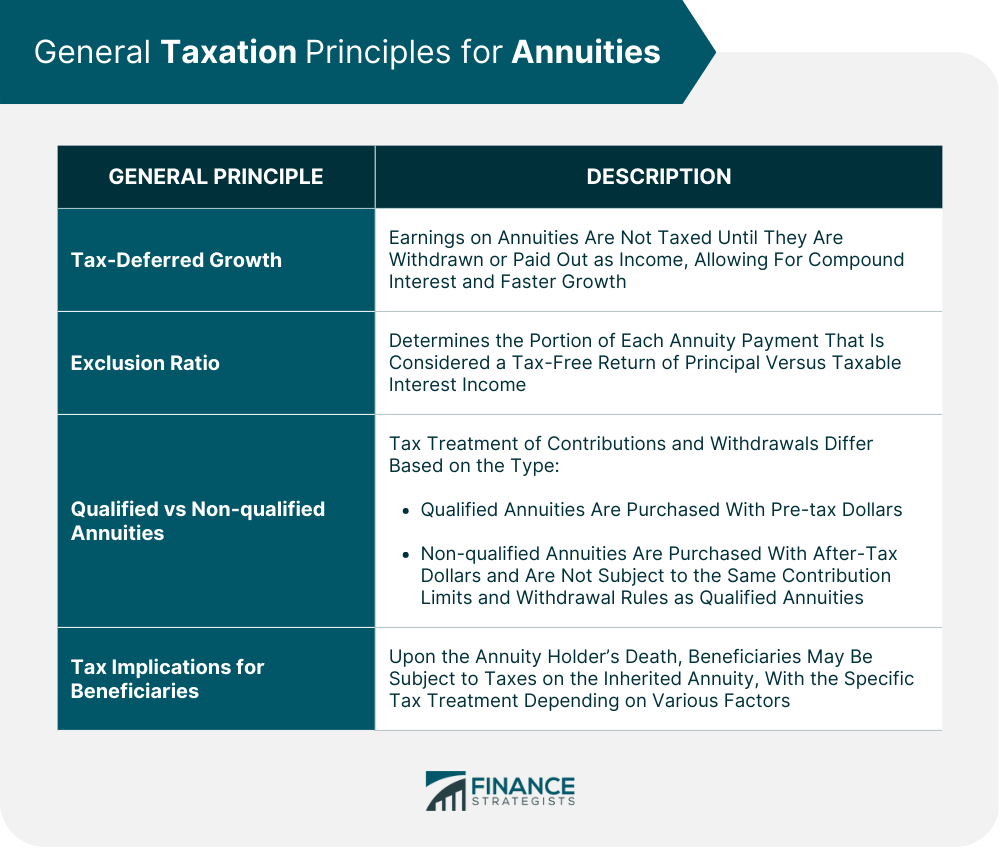

Dividing an annuity in a separation can have extreme tax effects. If you own a certified annuity probably it was part of a pension, 401(k), or other employer-sponsored retirement plan moneyed with pre-tax dollars you will certainly need a (QDRO).

This suggests that the recipient's share of the annuity profits would certainly pass on to successors if the recipient passes away prior to the agreement holder., was passed in 1974 to secure retirement cost savings and applies especially to retired life plans funded by personal staff members.

Taxation of inherited Multi-year Guaranteed Annuities

A non-designated beneficiary is an entity such as a charity, trust, or estate. Non-designated recipients go through the five-year regulation when it comes to annuities. So, if you acquire an annuity, what should you do? The response depends on a selection of aspects connected to your monetary scenario and personal goals.

If so, you might take into consideration taking the cash at one time. There's absolutely tranquility of mind in possessing your very own home; you'll have to pay home taxes, however you will not need to worry regarding landlords increasing the rent or sticking their nose in your organization. (We all understand just how much fun that is.) The tax obligation liability and fines you incur by paying in your annuities at one time can be offset by the benefit from that brand-new company or the gratitude value on a home.

Table of Contents

Latest Posts

Breaking Down Pros And Cons Of Fixed Annuity And Variable Annuity Everything You Need to Know About Fixed Income Annuity Vs Variable Annuity Defining the Right Financial Strategy Pros and Cons of Vari

Highlighting the Key Features of Long-Term Investments Key Insights on Indexed Annuity Vs Fixed Annuity Breaking Down the Basics of Investment Plans Benefits of Choosing the Right Financial Plan Why C

Analyzing Strategic Retirement Planning Everything You Need to Know About Financial Strategies Defining Fixed Vs Variable Annuity Pros And Cons Features of Tax Benefits Of Fixed Vs Variable Annuities

More

Latest Posts